By: Jennifer McMillen Smith, LISW-S, HIV Social Worker at MetroHealth Medical Center and medically reviewed by Ann K. Avery, MD, Infectious Disease Physician at MetroHealth Medical Center

Regardless of your status, it’s a great idea to manage the stress in your life as much as you can. It helps keep you healthy and allows your meds and your immune system to do their jobs.

For most people, stress is a big part of life. One of the biggest causes of stress is money — not having enough of it, not knowing how to make it, not being super responsible with it when you do have it.

But like it or not, money is a big factor in all of our lives. Can you imagine how much less stressed you would be if you weren’t worried about how you were going to make it to your next payday?

How can you reduce money stress?

We know what you’re thinking, “What can I do about money if I just don’t have enough of it?”

For starters, you can create a plan. Either you manage your finances or your finances manage you.

When finances manage someone, they’re always thinking, “I can’t do that because it costs too much,” or, “Everything would be so much better if I had more money.”

That’s letting money — or the lack of it — determine how your life works out. And it’s the source of most money stress.

Now, if someone is managing their finances, they’re thinking, “What kind of life do I want?” and, “How can I change my financial situation to get there?”

See the difference? It’s all about taking charge with a can-do attitude.

Next, let’s look at some smart ideas for managing your money.

Set financial goals

Imagine you want to drive down to Dayton. You pull up Google Maps, put in an address, and the map shows you the most direct route.

Financial goals are like that map: They tell you which way to go with your money. You know what travel is like without a map — you waste hours, miles, and gas on wrong turns.

Financial goals help eliminate the waste.

You might start with an easy goal you know you can achieve. Something like, “This week I’m saving an extra five bucks from my paycheck.” Earning that goal will give you the confidence to make more ambitious ones.

Maybe you want to pay down your credit cards or improve your credit score. You have to start somewhere and give yourself a base to build on.

If you don't know where to start and feel overwhelmed, try this:

Set a goal of spending one hour per week learning about personal finance. Money can be intimidating — but everyone has to start somewhere. We’re not expecting you to become the Wolf of Wall Street! Check out some of the resources we listed at the end of this blog to learn more.

And kick yourself in the butt every week to keep doing it because guess what: Nobody’s gonna do it for you. They got their own money to manage.

Create a budget

A budget is step one to getting good with money. It’s where you figure out how much money you’re making and how much you need to spend.

First, write down all the things you have to spend money on each month: rent, gas money, food, etc. Then include the things you want to spend money on, the fun stuff like trips to the movies or nights at the club. That’s the expenses section of your budget.

Next, figure out how much money you’re making each month.

Use this budget to plan how to spend your income every month. You can also use your budget to look for ways to spend less or earn more. The goal is to make more money than you spend.

Track your spending

Your budget gives you a base for tracking expenses. Write down how much you spend every day, and count it all up at the end of the week and the end of the month.

This is where you start asking yourself why you bought everything. Obviously, you need food, shelter, clothing, and warmth. If you have kids, that complicates it even more. But a lot of people spend money on stuff they can do without. For example, eating out is more expensive than cooking your own meals.

Once you have your budget and start tracking spending, you’re ready to become a real-life money manager.

Because now you can figure out where you might be wasting some of your money. And that’s where you start having money left over in your budget that you can start saving for the future.

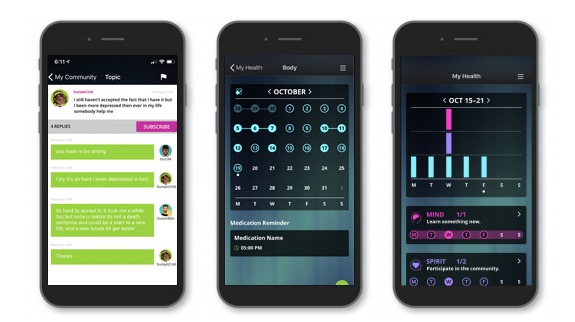

Come join our private, stigma-free, supportive community.

Health management tools with medication & appointment reminders.

Social networking in a community conversation & private chats.

Find ways to start making more money

After cutting some unnecessary spending, the next-best way to improve your financial situation is to earn more money.

Think about asking your boss for raise (if you don’t ask, the answer is always “no.”). But don’t just say, “Gimme more money.”

Ask your boss how to get better at your job so the company is getting its money’s worth when it pays you more.

Another option is to work more hours or try a part-time job. And lots of people these days are doing “side hustles” — little jobs that boost their income and sometimes create more opportunities.

Ask your friends, family, and co-workers for ideas on making extra cash.

Just try (really try) to keep it legal. We’re not judging. We’re just saying the risks of attracting the cops totally outweigh the rewards. You can’t get back time and money lost to courts, lawyers, and worse.

Open a savings account

Money in the bank is a load off your mind. And it’s a cash cushion that helps you ride out the bumps in your financial life.

Go to a nearby bank and find out what it takes to open a savings account. Every week, put a little bit of money into it. It could be $10 or $20, it doesn’t have to be a lot. You just have to keep doing it regularly. In a year, you can save up a nice chunk of change.

There are even some apps that will help you start a savings account right from your phone. You can set them up so it automatically takes a little bit of money out of your account at a time, so you don’t have to even think about it.

Get schooled

You can learn a lot about financial management without entering a classroom. Try these resources:

- ESOP Cleveland offers financial literacy/coaching, homebuyer education, tax preparation, and foreclosure prevention.

- Cleveland Housing Network Community Training Center can train you to handle a bunch of financial challenges.

- YouTube. Lots of folks share excellent financial tips on YouTube. Try searching on “How to set a budget” or “How to improve your credit score” and find a video you like.

- You can find all sorts of excellent financial podcasts. Our faves are Bad With Money with Gaby Dunn and So Money with Farnoosh Torabi. Both are super easy to understand and the hosts won’t make you feel dumb if you don’t understand financial basics.

Are you ready to be a money manager?

There’s an old song lyric that goes like this:

“I make money, money don’t make me.”

Money is like that. It’s just a tool to help you capitalize on your time, talent, and determination.

Once you realize that, you’re on your way to becoming the best manager of your money.

Related Blogs: