By: Jennifer McMillen Smith, LISW-S, HIV Social Worker at MetroHealth Medical Center and medically reviewed by Ann K. Avery, MD, Infectious Disease Physician at MetroHealth Medical Center

Let’s face it, credit can be an intimidating topic to learn about if you’re not a financial analyst. You may feel like you don’t know the first thing about credit scores and ratings, but it doesn’t need to be overly complicated. We’re going to dive into why credit scores are so important and what you can do to build up good credit.

What is a credit score?

Your credit score is a number that estimates how likely you are to repay your debt. Banks and lenders use it to determine if they’ll approve you for credit cards and loans. Your credit score falls somewhere on a scale of 300 to 850 and is determined by the three credit bureaus: Equifax, Experian, and TransUnion. They determine your credit score based on a bunch different factors that we’ll get into later on.

If your score is 700 or higher, credit lenders consider you a low-risk investment and think you’ll be more likely to pay them back based on your credit history. For that reason, a score of 700 or higher is considered a good or excellent credit score.

While there are a bunch of different credit-scoring models out there, FICO remains the most popular. FICO scores are determined by the different balances you owe, how long you’ve had credit, and some other factors as well.

Why credit is important

Your credit rating can have a big impact on your life. It might seem like credit might just have to do with credit cards, but any retail credit cards you open, your personal loans, auto loans, student loans, and mortgage also factor into your credit score.

The better your credit is, the more financially stable your future could be. After all, your credit history affects whether you’re able to borrow money to buy a house or a car. Good credit can also get you better interest rates on your auto and home insurance. That can end up saving you a big chunk of money every year! If a financial emergency comes up, the higher your credit score is, the more prepared for it you’ll be.

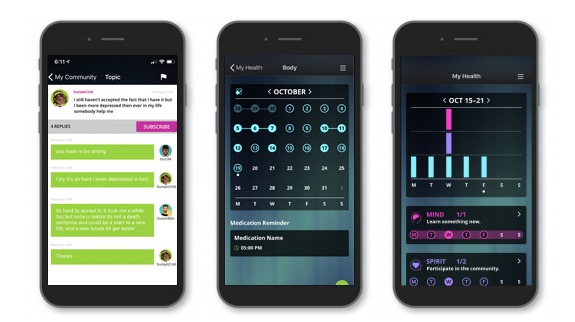

Come join our private, stigma-free, supportive community.

Health management tools with medication & appointment reminders.

Social networking in a community conversation & private chats.

What makes a good credit score?

There are a few things that get factored together to determine how good your credit score is. They include:

- Your payment history. Any late payments on your credit cards, rent, utilities, loans, or anything else can lower your credit score.

- How long you’ve been building credit. It can actually take a long time to build up good credit even if you make all your payments on time. If you’re new to the credit world, don’t be discouraged, everyone needs to start somewhere! Try your best to be patient and keep at it by paying all your bills on time.

- The types of credit you have. That can include student loans, auto loans, credit cards, mortgages, and more.

- Your credit limits and how much of it you’re using. In a perfect world, we’d all be able to pay our credit cards off each month and have no remaining balance. If you’re unable to do that, aim to keep your balance under 30% of your limit to help build your credit.

- Your total debt. This includes any balances you still have that need to be repaid.

It’s important for you to know what your credit score is. If you have at least six months of credit history, you can find out your credit score and get a free credit report each year from each of those credit reporting agencies we mentioned before. If you don’t have at least six months of credit card payments under your belt, you can also estimate your FICO score.

Advice to build your credit

There’s a lot of good advice out there to help you build your credit. If you’re new to the world of credit, it can be really tempting to open a lot of new cards all at once, especially for each store you shop at, but that isn’t normally a good idea. The more cards you have, the easier it is to lose track of your balances and even forget to make payments. Starting with just one credit card is typically your best bet to start building your credit.

There are tons of different credit cards out there. Keep these points in mind when you’re doing your credit shopping and looking to build credit:

- If you want to build your rating but have little or no credit, you might want to start your search by looking into a secured card. The thing is, if you don’t have much credit, some credit companies may not want to give you a credit card since they have no idea if you’ll pay it back. Getting a secured card and making payments on time for a year will likely be enough to build the credit needed to open an unsecured card.

- Watch out for credit cards that have annual fees. With so many cards out there, you’ll likely be able to find one without all the extra fees.

- One of the most important ways to build your credit is to pay all your bills on time each and every month. This includes even your rent, utilities, and student loan payments.

- Don’t put more on your credit card than you can pay off each month. Of course, unexpected things sometimes happen, but you don’t want to get stuck in a pattern of “revolving credit,” that is, when you’re still paying off something you bought months ago.

- Keep track of your monthly balance and annual report. This is how you can catch any errors, fraud, or identity theft.

- Educate yourself by listening to podcasts or reading books or articles about ways to manage your money and build your credit.

Strategies

The best credit card strategy is to only use your card to make small purchases that you can pay off within a month. Interest gets tacked onto your credit card balance each month you’re unable to pay it off. Paying off the balance keeps you from having to pay these extra charges.

If you want to buy something that you know you won’t be able to pay back within a month, you’ll have to be strategic about it. Think about whether it’s something you really need or if it’s just something you’d just like to have. Consider putting off buying it if you don’t really need it. If you do need it, though, maybe make a plan to save up some money for it so it’s not all going on your credit card.

Having credit helps prepare you for when emergencies happen. Paying off your credit cards and loans on time helps establish your payment history, which is important when emergencies happen.

Credit plays a big part in building a secure future for both you and your family. Maybe it seems like a long way off now, but making smart decisions to build your credit today can benefit you for years and decades to come!

Related Blogs: